2019: You Will Use Fair.com for an Open Ended Lease

I reviewed my experience being a very early user of Fair.com, and it’s gotten some attention from folks around town. Quite a few readers are adding discount codes in the comments. These discount codes may offer the person sharing them with you a discount on their current or future Fair App car. It’s impossible for me to be certain as I’ve never had a discount code of my own to share with you.

Drivers around the US are enjoying their car ownership with Fair which leads me to believe that the customer service is improving. Yet, even if the customer service experience doesn’t improve I will still use the Fair App in 2019 and here are a few of the reasons why.

I will need another car for a short period of time, in fact, I will need two (I hope).

You see, my BMW lease ends in February and I’ll be dropping that car off at the dealership, waving goodbye to the hardtop, and becoming a practical woman. The inevitable repairs will be the next owner’s issue. From February to August I will need a car of my own, and then in September my son will head out of state to college and I’ll be driving the car we bought for him. His car has a reasonable amount of luxury and a lot of life left to it, and we’ll keep that thing until the wheels fall off.

When the kids come home for summertime, they’ll need cars to drive and we’ll bump up against that prohibitive car rental fee for anyone under age 25. The only reasonable solution is a Fair Car.

Though I plan to drive the kid car, I think we all know I have an insatiable appetite for newer, faster and more fun vehicles.

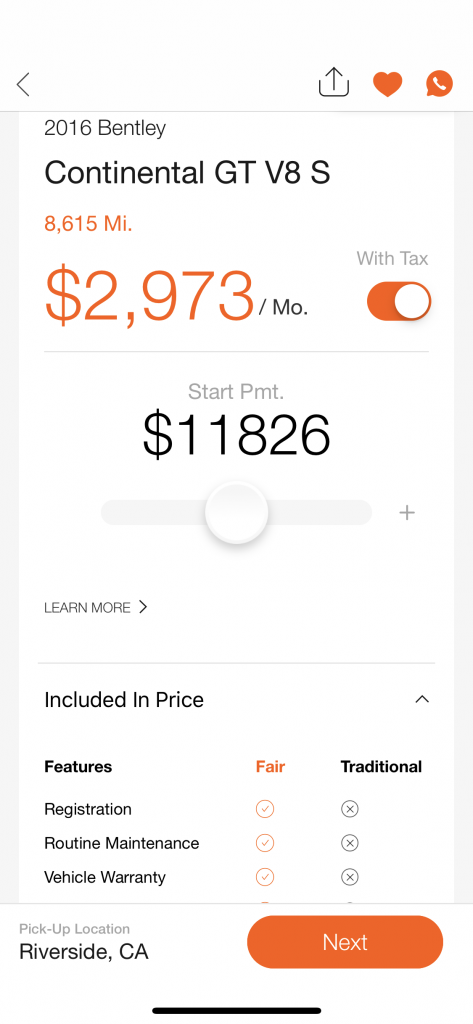

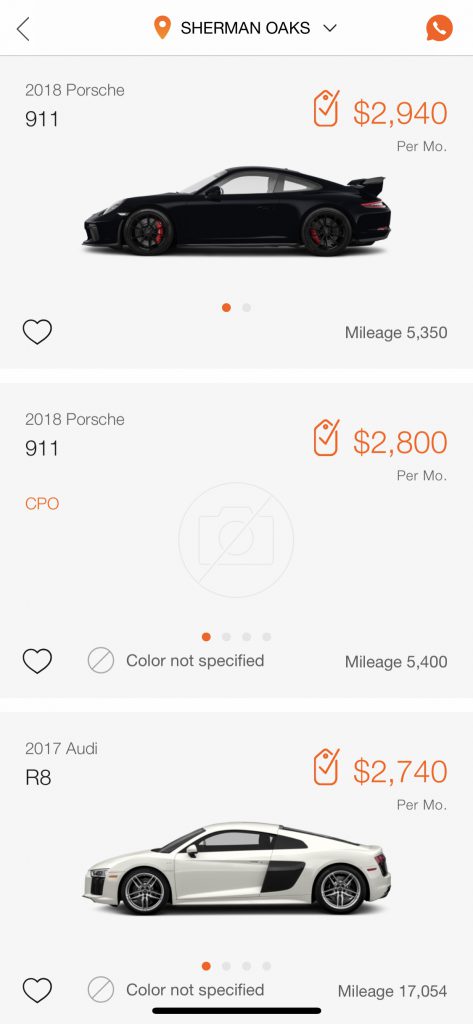

If $10,000 drops out of the sky, I’m going to plant myself into a 2016 Bentley Continental Convertible with less than 10,000 miles on it. I’m going to bump the mileage up from 5,000 to 10,000 a year and use that thing as my daily driver, and three months later when I’m out of money I’m going to give Fair.com five days notice and have that sucker picked up.

I circled this because it matters and because my experience was that it’s completely true (yet hard to believe).

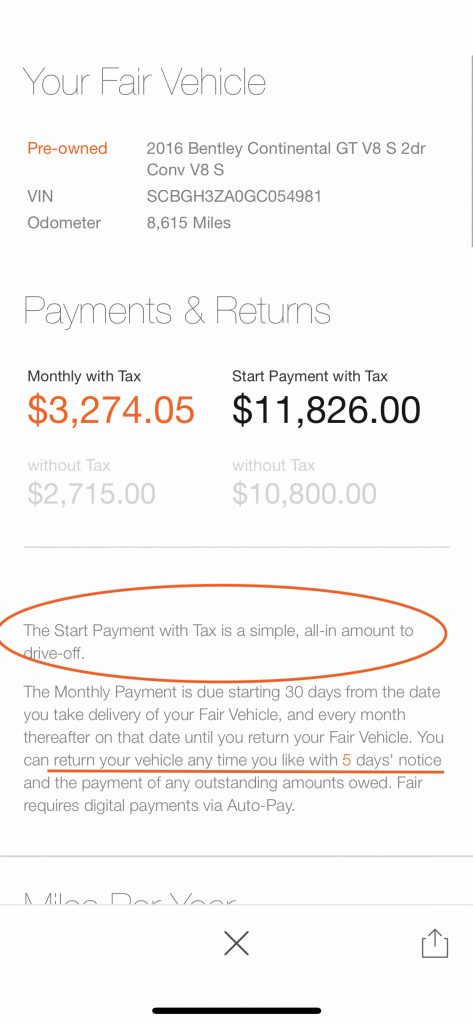

Or maybe a Mercedes SL?

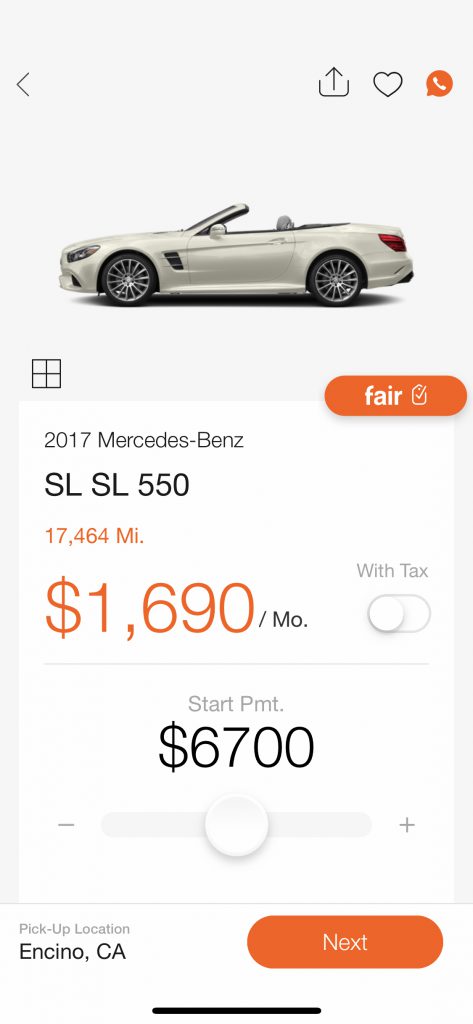

Or a Tesla? I want to love the Tesla, but it’s a challenge. I’m more likely to get into an R8. The kids don’t need to go to college… right?

Once you get into low six-figure vehicles, the options for low mileage vehicles are astounding. I’m not sure if this is unique to Los Angeles. Porsche buyers seem to have automotive ADD. These owners are continually turning in 911s of every engine size and trim level after a couple of years and about 5,000 miles. I don’t know if these are weekenders or one of many vehicles these folks own but I do know that if I wanted a 911, there’s no good reason (fiscally) to buy new. There are about a million great reasons to buy new, but they’re all emotional.

I was excited to see some of my favorite luxury and exotic cars on Fair.com. I would not be excited to have to negotiate a purchase of any of them; an open-ended lease seems like a fantastic idea.

People move to Los Angeles from everywhere in the world, and they are baffled by our credit score system.

You can be completely loaded and unable to qualify for a low-interest car loan or a reasonable lease. Having little to no credit history makes life absurdly expensive, and Fair.com uses a slightly different system of determining payments. Immigrants and other people with little to no credit history will find that Fair.com is an excellent solution.

Let me explain why I’m a cheerleader for Fair’s lending practices. Jalopnik has a series of articles about the subprime auto lending industry and what it can do to a person, to a family and ultimately to an entire courthouse. The most detailed article concerns the predatory practices of Credit Acceptance, where a full 35% of the vehicles they finance end up repossessed. I highly recommend reading this.

The nightmare of a car repossession isn’t in the loss of the car. The financial disaster of having a vehicle repossessed is that the loans are still payable and due. It’s not uncommon for buyers to be paying off a repossessed vehicle many years after it has been taken from them. Less common, but not unheard of is for the collections process to last decades.

Both of my children have taken financial literacy classes in high school. I have demonstrated to them a million times with numbers, charts, graphs, and one time even batches of marbles the magic of compound interest. I’ve shown them the import of saving early and often and the devastating effects of revolving debt. I still expect that car leases and loans will confuse and prey upon them.

A repossessed vehicle becomes the worst kind of debt ever. It’s like credit card debt with a devil gleefully running a collection agency.

If there is even a whiff of the instability of income, location, or job security in your world Fair.com is a solution that I wholeheartedly endorse.

I’ve thought about this predicament near-daily for months. The October article about Credit Acceptance really stuck with me. If these people had a car from Fair.com and fell behind in their payment, it would be picked up within the month. They would owe just one car payment. Though unpleasant, it’s not the sort of thing that sends a family into bankruptcy as so many subprime auto loans have.

The open-ended lending model may feel expensive compared to the advertisements you see. With the potential for financial ruin taken out of the equation, it makes sense. Further, when reading the lending statements surrounding advertised leases the mileage is far from sufficient, drive off fees are obscene, and security, tax and disposition fees are hidden from even the fine print. The Fair.com app generates a lease agreement that users can print and read at home or work. It’s a remarkably simple document for a complex transaction, and as stated before, my lease terminated with no surprises.

Sometimes we look at money and worry about cash outlays, mistaking that for expensive. The reason cars are too expensive is that a three to five-year commitment is based on a monthly payment and fees are tacked on in confusing ways. There’s a lot of dazzle in the foursquare and it forces people into contracts that make little sense. Unless a buyer is well established or under contract at work, it’s easy to have finances shift.

I worry about millennials. With home economics removed from education, a dizzying array of never before seen financial options are offered. Some of these are liberating, others send families to financial ruin. The confusion must be intentional.

At the end of the day, cars are just a lot of metal and rubber run by 73 small computers and topped off with a dollop of cloth or leather. They get us to our jobs, our joys, and often are the second largest bill after rent or mortgage. Treating vehicles as financial objects is prudent as we enter a rocky economy.

I’ll continue to wait for my gazilion dollar windfall and my convertible Bentley.

In the interim Fair.com has thousands of vehicles under $400 a month, many of them CPO. There’s a special category for uber drivers that I’m curious about. I’d love someone to share that information with me.