It’s time for open enrollment at Mr. G’s workplace. I spent an hour trying to figure out how much we might spend on healthcare and childcare next year so that we could contribute the appropriate amount to the Flexible Spending Accounts (FSA’s). Life insurance is a no brainer, we get the maximum for him and the maximum for me. It’s less than $10 a month and it’s not a whole lot of insurance, but it’s something.

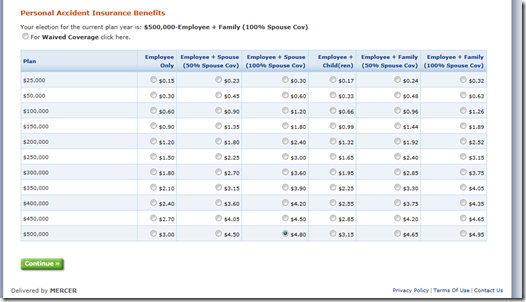

This year I noticed something different on the life insurance options. Take a look for yourself.

The options are as follows:

- Employee only

- Employee + Spouse with the spouse at 50% coverage

- Employee + Spouse with the spouse at 100% coverage

- Employee + Children

- Employee + Family with the spouse at 50% coverage

- Employee + Family with the spouse at 100% coverage

So I had a little freak out. Because who buys life insurance for children? How would $25,000 help me if something happened to one of my kids? I’d be too busy launching myself off a cliff. I know there are those whole life policies that provide a little savings account… but the thought of it was gruesome. If something happens to Mr. G the kids and will need a shit ton of cash because he does everything here. Everything. If something happened to me Mr. G would have to work very differently and hire someone to replace me. That all makes sense and for a few dollars a month I’ll buy some insurance.

When I thought about possibly clicking the column that would insure the kids I became physically ill. It’s just not something I could insure. Crazy?

Also, I’m off to Mexico tomorrow, specifically Puerto Vallarta. I wasn’t able to get K&R insurance, but I’ve promised my mother I won’t die. I also didn’t update my will. But Mom I’m pretty sure blogs are legal documents so if the plane drops out of the sky please make sure everyone knows that we want my brother to raise the kids. There’s plenty of life insurance and he can have my house. Just make sure no one wears their shoes upstairs, because I’d spin like a rotisserie chicken if my kids were being raised like that.

Term life for kids? No. Whole or Universal Life? Yes. Why, you ask? Because it is a guaranteed insurability that will follow them for the rest of their lives. That they can use to protect their own children someday. Or use the cash value to do something with in an emergency. But term on kids? No way.

I buy the work sponsored life insurance on my kids. If one of my kids dies, I am pretty sure my PTO isn’t going to cover the amount of time I’m going to need to take off of work. I am also going to have cover funeral expenses I clearly have not budgeted for. What I find more interesting is that spouses can be covered 100%. I’ve only ever been able to cover my spouse for 50%.

Goes without saying that of course I wish kids didn’t die. As a mom that lost a child though, I can tell you that funerals are expensive. I know of one family that dug their child’s own grave because they couldn’t afford it. From the sounds of it, your family wouldn’t be in that situation, but still the funeral would be outrageous, and then consider loss of work time on top of that. Gah. I so dislike even having to talk about this. But, I think I’d insure my entire family if given the choice. (We were lucky, everything was donated for us)

Hope you used Simplee to figure out your medical costs! =)

My friend got life insurance for her kids under the theory that, as Kristine says, funerals are expensive and also that if one of her kids dies she’s going to want to take some off to grieve without everything going to hell for the rest of the family.

Beth I did use Simplee to estimate how much we’d need for our FSAs.