College is settled. We know where Alexander will be going and, like most first-year students in American schools, bringing a car is highly discouraged. We had anticipated this when I bought his car a few years back, which is why his car is practical enough to be mine when he leaves.

I turned in the BMW yesterday. I loved it, but hardtop convertibles are quite naturally slow. I would love something faster, but I am not ready to give up having a convertible. I need a car to take me from February to September. Seven to eight months, depending upon how quickly I move.

There’s always the rental car option, but rental cars are smelly, unpredictable and not often fully loaded. I could take over another lease, but that would be a little longer than eight months and finding the perfect car that way takes quite a bit of time and energy. Being that there are no cars that excite me I’d prefer to expend my energy elsewhere.

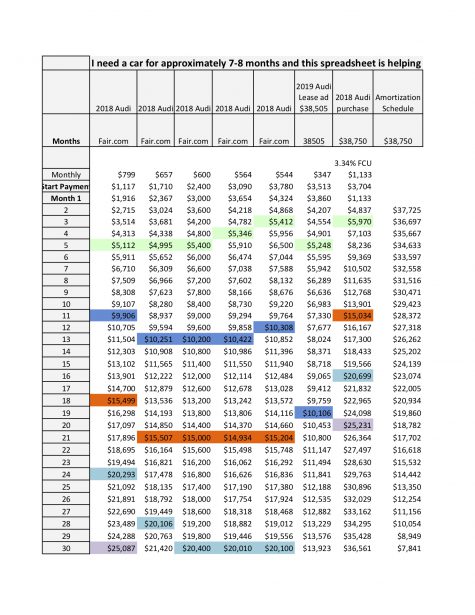

I’m coming back to Fair.com and all its options. I found two Audis I’m interested in and three different ways to pay for them. I also found a comparably priced new Audi and used the leasing special they have advertised on Audi.com to compare a traditional 36-month lease with some options from Fair.

Then I found a Mercedes, and in the spirit of having a really tough to follow spreadsheet I added that too.

If you’re an accountant, I recommend NOT looking at my spreadsheet. It will probably make you itch.

Here is a spreadsheet I made for myself. It’s a breakdown of short term car leasing options with Fair.com, a traditional 36-month lease for a comparably priced vehicle, and a used car loan breakdown with an amortization schedule. All cars are priced $38,000 or high, all are Audi or Mercedes late model cabriolets.

I’m pretty sure I’ll go with the C 43 AMG even though it’s not a car I’d buy. I think that’s the point of Fair. If I’m going to drive something for 7 months then it should be a car I wouldn’t typically buy myself. Right?