How To Buy A New Car In Any City

New car shopping is confusing. It’s meant to be confusing. I know this because I’ve bought many cars. Rest assured I’ve sold many more cars than I’ve bought.

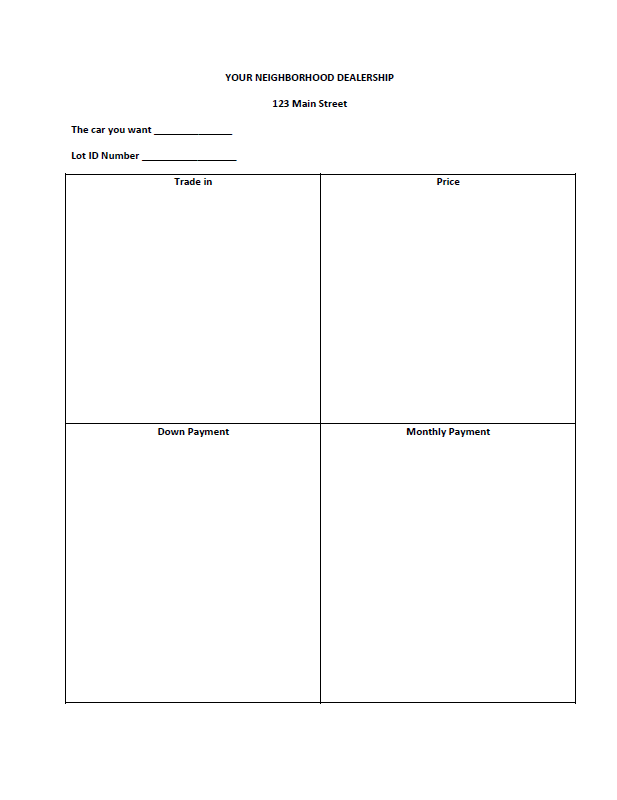

If you try to walk into a dealership you will be shown a car by a salesman, presented a foursquare, and then your salesman will broker a deal between you and the dealership. This sounds good, the problem is that car sales people are never on your side, and quite often when they run into the office to talk to the manger they’re reading the sports page, because they already know the numbers and they already know that you can’t have what you want at the price you were hoping for.

So, if you see a piece of paper that looks like this it’s called a foursquare. It’s a sign that it’s time for you to go back home and buy a car my way.

Here is how I recommend you buy your cars when you are planning to own it either by paying cash or by making payments to an institution, as well as how I recommend you lease your vehicles.

Steps to purchasing a or leasing a car:

1. Test drive everything:

Go test drive every vehicle you think you’re interested in and pay attention to what you like. Take notes because cars cannnot be compared side by side. Let the salespeople know that you are not buying today. Take a low pressure test drive and know exactly which car you want, the trim level and the features you care about. Only after you know what you’re looking for do you buy a car. Do not, under any circumstances, buy a new car the same day you test drive it. You are guaranteed to have buyer’s remorse.

2. Know your credit score.

Experian will give you a free credit report once a year. If you’re financing in any manner it is critical that you know your credit score. Some leasing or borrowing programs may or may not be available to every buyer.

3. (for buyers) Call two fleet departments.

Pick up your telephone and call two competing dealers, ask for the fleet manager. It is quite likely that the fleet manager only works Monday through Friday 9-5. They’re probably older than everyone there and grumbly. They might say things like “rubber and metal, that’s all they are”. This is okay. The fleet manager doesn’t care about you because you don’t manage a fleet. The fleet manager wants you to take your car and get the hell out of their office.

When you have the fleet manager on the phone you will tell them exactly what you want in your car. Start with the make and model and then move onto every bit of trim that could be imagined. Ask them if they has it in stock or if it’s something they can locate for you. The answer will be “no” because most buyers want a car that’s never been made but they will give you a few options that are very close to what you’d wanted. Now ask them for the internet fleet price (I used to recommend getting AAA and asking for the AAA price but I found that they don’t negotiate as well as they used to). The manager will throw a number at you and explain that it’s $200-$1000 over invoice. If you’re looking for a hard to find car it may be more, but $250-$500 over invoice is very fair.

Now you need to hang up the phone and have the same conversation with another fleet manager at another dealership. Take notes during your phone call. If you live in a small town or a rural area don’t be afraid to call out of state. I’ve sent cars across the country for as little as $600 in covered trucks. It’s an option worth looking into.

3. (for lessees) Call two fleet departments

Call and ask for the car just as a buyer would, only don’t ask about the price. Ask what the minimum drive off is based upon your credit (see step 2) as well as the monthly payment. If you think there is any chance of buying the car at the end of the lease (that would be fiscally irresponsible and I don’t recommend it) be sure to ask what the residual value is. Don’t lease a car one day longer than the warranty. Three years is typically the best deal on leasing, but if the warranty lasts five years you could go to a 48 month lease. This could help get you into a car you’re stretching a little to afford. Still, most often 3 years is the ideal.

Anecdotally, I have had wonderful experiences with BMW, Ford, Chevy, and Kia leases. I have found that Audi and Porsche leases are very unpleasant to exit even as their vehicles are wonderful to drive.

5. Trade ins:

If you have a trade in most places will give you the same price. It’s a formula and it’s only emotional for you, the owner, no one else cares about your car. In most scenarios your old vehicle is going to an auction, so a few sales will be involved before your car hits a car lot. If you need to get top dollar for your vehicle trading in is not the right move for you. If you (like me) aren’t interested in dealing with a buyer, get a price from Car Max and then trade the thing in or drop it at Car Max and never look back.

Do not get your new vehicle pricing and your trade in offer at the same time. They are separate events. Dealerships want you to be confused with a bundle of numbers and that’s why they wrap the trade into your deal.

6. Compare your two offers.

Typically one dealership will be much easier to deal with or one price will be much better than the other. When you find the numbers that work for you have a contract emailed over, look at it carefully and then make an appointment to have your car delivered or to pick it up.

Most of all, have fun. I love a new car.